![]() FDIC-Insured – Backed by the full faith and credit of the U.S. Government

FDIC-Insured – Backed by the full faith and credit of the U.S. Government

![]() FDIC-Insured – Backed by the full faith and credit of the U.S. Government

FDIC-Insured – Backed by the full faith and credit of the U.S. Government

Our premier account offering you value, increased security, and special discounts

Our best value with fuel rewards, insurance, identity protection, and more.

Local discounts and national retailer deals to save you money.

Save money on prescriptions, eye exams, frames, lenses and hearing services.

Receive up to $800 per claim ($1,600 per year) if your cell phone is broken or stolen.

Available 24/7 and free to use, up to $80 in covered service charges.

Peace of mind for the unexpected.

Identity restoration, payment card protection, and personal identity protection.

Items are protected for up to $2,500 per item if theft or accidental breakage occurs during the first 180 days of purchase.

Let our team of experts negotiate your internet, TV, cell phone, and home security.

Earn 10¢/gal for up to 20 gallons each month with just 15 debit card swipes.

Unlock exclusive savings and benefits with the BankSouth Rewards app!6 From local discounts to travel advantages and protection benefits, download today and start saving. Available now in the App Store and Google Play.

Save a trip to the bank. Open your Complete checking account online.

We understand your banking needs aren’t always done between the hours of 9 and 5. That’s why we offer you convenient access to services like EasyOpen. Our online account opening tool gives you the same ease and security in opening an account that you would receive in our branches.

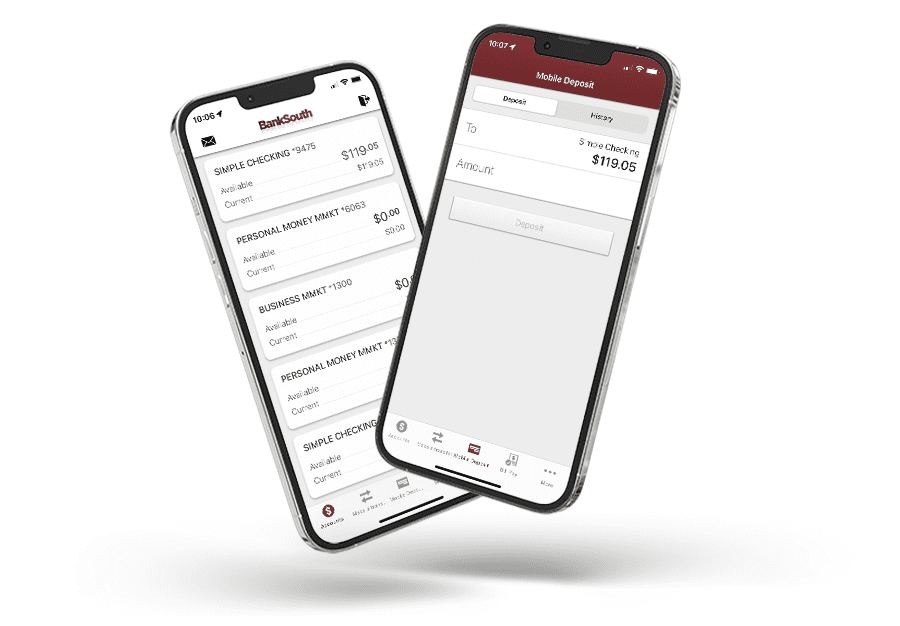

We’re local – and everywhere you need us to be. Manage your Complete checking account online and on your phone. With our easy-to-use online personal banking technology, you can:

It’s easy to enroll, easy to use, and fully secure. It’s your local bank available from your fingertips.

1Participating merchants on BankSouth Rewards powered by BaZing are not sponsors of the program, are subject to change without notice, may not be available in all regions, and may choose to limit deals. 2 Subject to the terms and conditions detailed in the Guide to Benefits. 3Insurance products are: NOT A DEPOSIT. NOT FDIC-INSURED. NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY. NOT GUARANTEED BY THE BANK. 4Billshark, identity monitoring, and credit monitoring each require additional activation to begin. 5 You’ll receive a one-time activation reward of $0.10 per gallon when you activate BaZing Fuel. You’ll earn a monthly reward of $0.10 per gallon each month when you have 15 eligible debit card transactions post and settle during the Monthly Qualification Cycle (MQC), which is defined as the first day of the month through the last day of the month. Only transactions posted during the MQC will count towards the monthly reward for that MQC. The following activities do not count toward earning BaZing Fuel: ATM withdrawals, transfers between accounts, deposit or refund transactions. Transactions posted during the MQC greater than the monthly reward requirement will be stored to count towards a bonus reward of $0.10 per gallon. When you have 50 stored bonus transactions you will earn the bonus reward. You will continue to earn bonus rewards for every 50 stored bonus transactions accrued. If the required monthly reward transaction count is not met during the MQC, no transactions are counted for any reward during that MQC or the bonus reward. BaZing Fuel is limited to 20 gallons of fuel per purchase, per vehicle, or fraud limits placed by Shell and/or limits placed on your payment card by your financial institution, each of which may be lower. To activate, you will need to have online banking with your financial institution. Refer to the BaZing Fuel Terms and Conditions for full disclosures. BaZing Fuel offer may be changed at any time and without notice. 6We charge an overdraft fee of $20 per overdraft which may be created by automatic bill payments, checks, and other transactions using your checking account number. We do not authorize and pay overdrafts on ATM and everyday debit card transactions. You must repay the overdraft amount and the fee within 30 calendar days after the overdraft. Whether your overdrafts will be paid is discretionary and we reserve the right not to pay. For example, we typically do not pay overdrafts if your account is not in good standing, you are not making regular deposits, or you have too many overdrafts. 7BankSouth Standard WOX checks (Wallet Oxford), basic BankSouth check with logo as the watermark. 8Qualifications to earn premium interest rate must be met each statement (qualification) cycle: At least $100 in Direct Deposits, 10 or more debit card transactions posted, and enrolled in e-statements.

Message and data rates may apply when using the BankSouth mobile app.